Extended M’s and W’s for greater profits. If you don’t learn this strategy, this is what will Happen!

- STANDARD RESULTS

- LIMITED RETURNS

- MISSING THE EDGE

Let the market come to you, do not chase trades, simply wait for the set ups to occur.

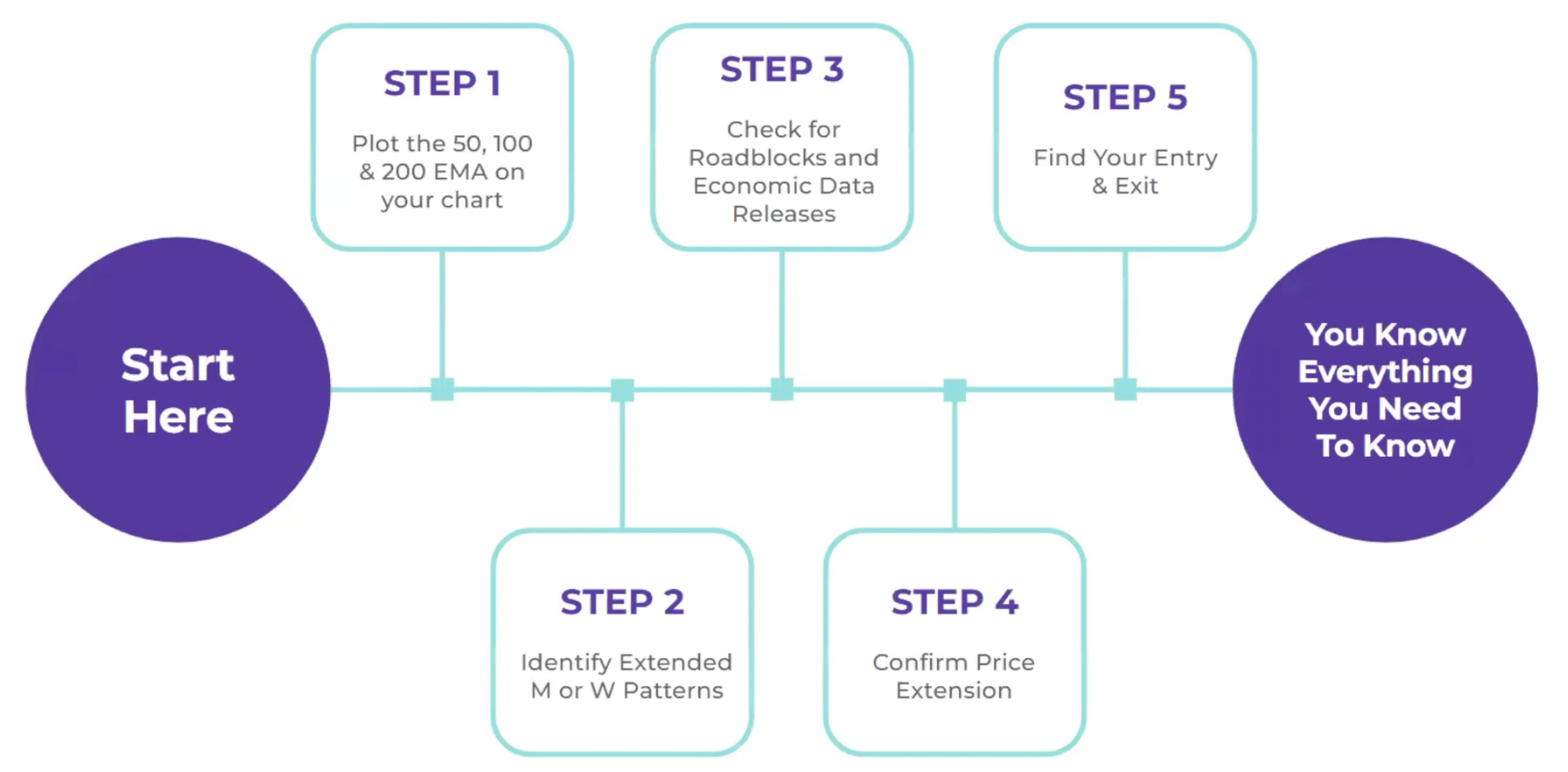

Identify Extended M or W Pattern

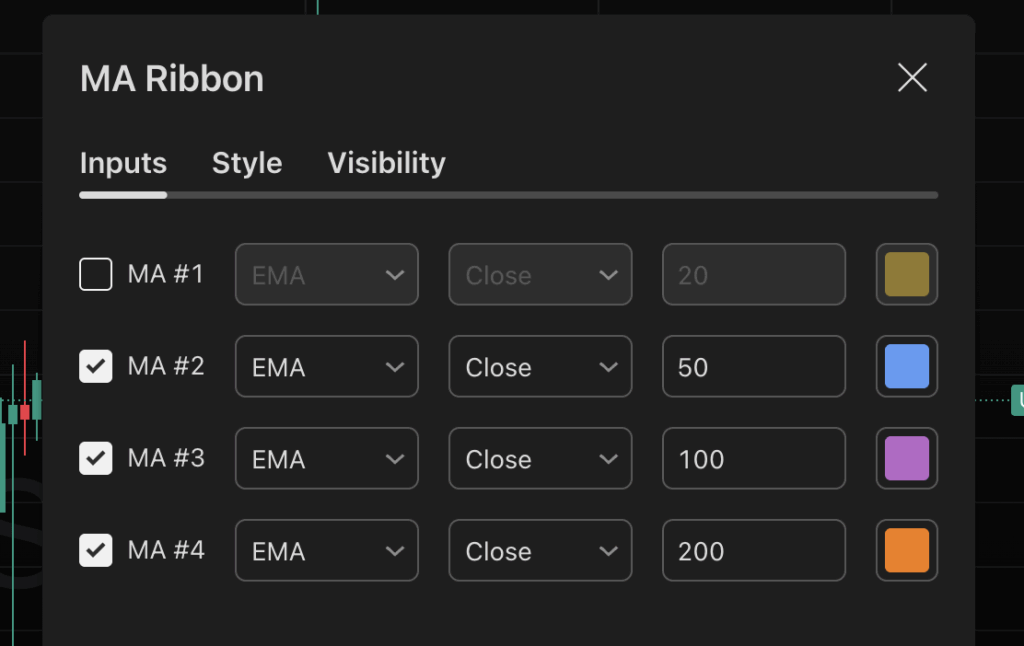

STEP 1 : Plot the 50, 100 and 200 EMA ribbon on chart inside TradingView using the indicators option.

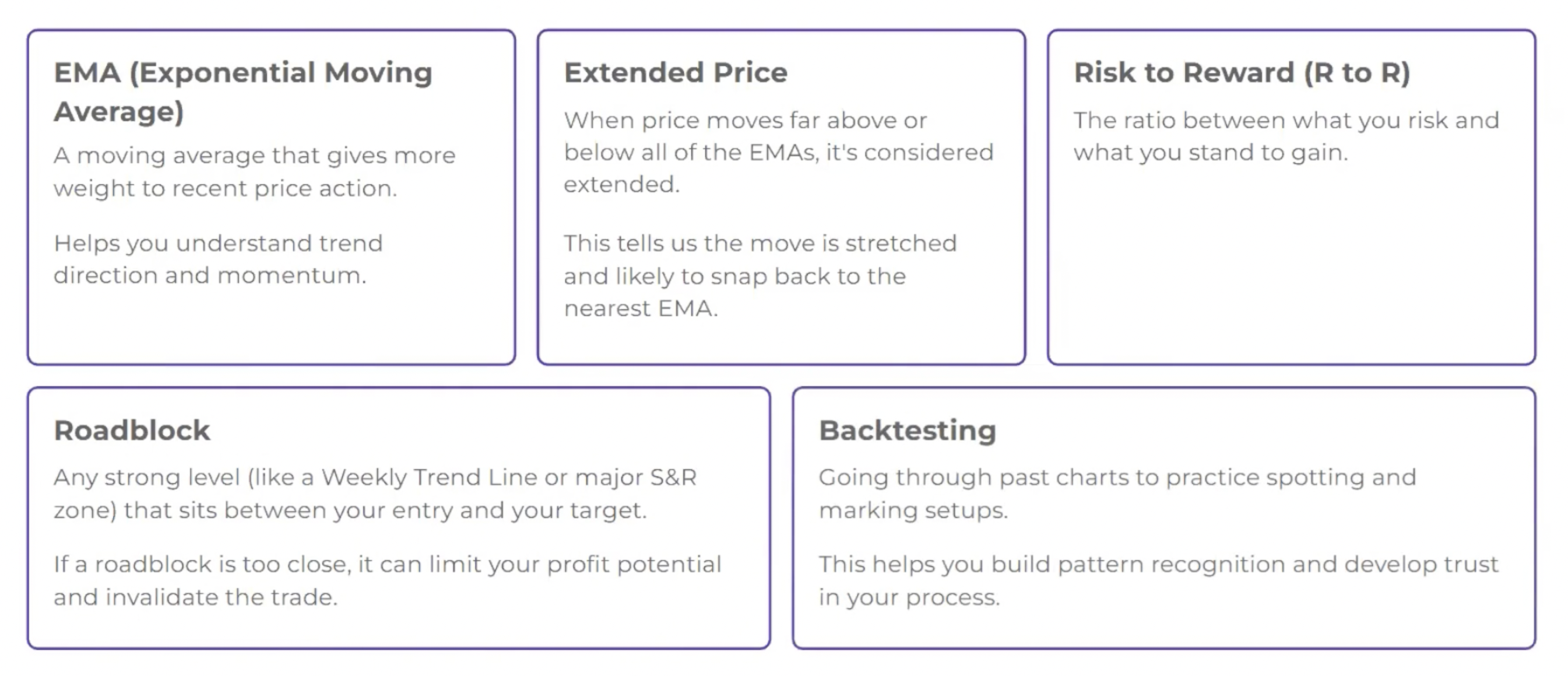

In order to establish that price is overextended we need to make sure we have a metric to measure it against. The EMA’s are a barometer of where price has been in the recent past. If price is well above or well below all of the EMA’s then it considered extended and will likely revisit the nearest EMA as a minimum.

To set the EMA ribbon, go into settings for EMA inside TradingView and set the following, where you can also set the colour for each ribbon ribbon.

Step 2 : Identify Extended M and W Patterns

If an M or W forms well above or below all of the EMAs then it is considered extended and not at its normal average price level. If extended them it is likely to revisit the nearest EMA at a minimum.

1. Wait for Pattern Formation

Wait for a valid right side of an M or W to form, where the neckline is above or below all of the EMA’s.

2. Plot Key Levels

Plot your stop loss as you normally would do and mark the level of the nearest EMA – drawing a vertical line up (if above) and down (if below) from the current candle.

3. Determine Trade Validity

If extended above the EMA’s use TV’s ‘short’ position tool coupled with your SL and TP levels, to determine if we have a risk to reward of 1 to 1 or better.

If R to R is better than 1 to 1, then the setup is valid and you can proceed to the next step.

If it is less than 1 to 1 then the setup is invalid and you wait for the next opportunity.

If extended below the EMA’s you complete the same process but use TV’s ‘long’ position tool.

Step 3 : Challenges

You may have difficulty in selecting the correct position to start your measurement from, or you may not recognise that price is extended far enough above/below the EMA’s.

If this is the case then watch the following video repeatedly until you fully understand the process, and then practice the process, using bar replay if available, until you are fully familiar with the process.